Republican lawmakers are considering major changes to the

banking regulations that helped steer the nation out of the Great Recession.

|

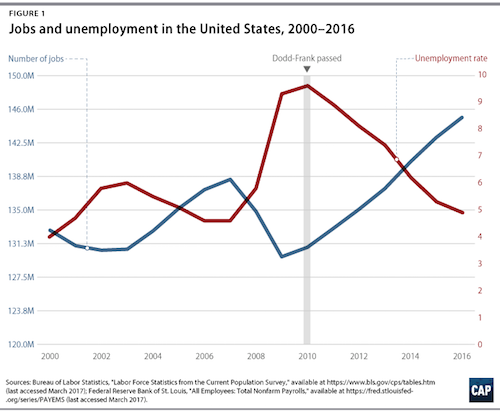

| Millions of jobs were lost when banking abuses collapsed the U.S. economy in 2007. The Dodd-Frank Act of 2010 set vital new rules for the financial industry, stabilizing the economy and creating millions of jobs. The Senate is voting this week on a bill that could undo that progress.

|

In March, the U.S. Senate passed a major rollback of the Dodd-Frank Wall Street reforms enacted in 2010, consumer protections that were intended to rebuild the economy and to put in place common-sense measures that would prevent another economic collapse like the one that started in 2008 and cost American workers nearly 10 million jobs.

But conservatives in the U.S. House argue the Senate bill didn’t go far enough to unleash the freewheeling, risky banking practices responsible for the downturn. Speaker of the House Paul Ryan threatened to freeze the bill if the Senate won’t agree to more drastically roll back the Dodd-Frank regulations.

“Whether or not this particular bill survives, Republicans will keep trying to destroy the laws that revived the economy and brought back our jobs,” IBEW International President Lonnie R. Stephenson said. “We all remember how bad it got after 2008. The recession was devastating for this Brotherhood and for our families, our friends, our communities. We can’t let that happen again.”

As passed by the Senate, the bill exempts two-thirds of the country’s 38 largest financial institutions from Dodd-Frank rules that brought more transparency and less risk to banking.

The law helped stabilize the economy, spurring sustained economic growth that created 17 million American jobs between 2010 and 2017 and has safeguarded consumers against predatory lenders and other banking abuses.

While the national jobless rate peaked at 10 percent before Dodd-Frank, unemployment among IBEW inside wiremen hit 26 percent when the construction business bottomed out. That rate steadily dropped after the bill passed and construction today is at or near full employment in much of the country.

Fighting against weaker rules, California Sen. Dianne Feinstein criticized supporters for forgetting “not only the lessons from 10 years ago, but also the devastating consequences for American families. In California, more than 2 million people were unemployed, 3.5 million mortgages were at risk and nearly 200,000 people filed for bankruptcy. We simply can’t return to that time.”

|

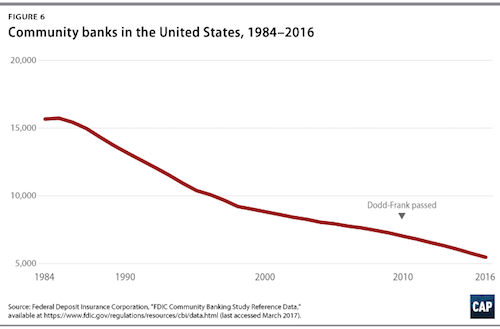

| Proponents of the Senate's bank-deregulation bill claim that Dodd-Frank put community banks out of business, and that the new bill will revive them. As this chart shows, the number of small banks has been in steady decline since the 1980s, long before the banking rules enacted in 2010.

|

That’s the risk Congress is taking, a high-ranking bank regulator warned during lawmakers’ Easter recess.“Memories are short and with an improving economy, these laws and regulations — which early in the recovery are viewed as essential — are eventually recast as burdensome constraints that need to be eased or ended,” Thomas Hoenig, outgoing chairman of the Federal Deposit Insurance Corporation said in a speech to economists.

As Ohio Sen. Sherrod Brown put it, “Whose side are we on? Megabank lobbyists, or American taxpayers and homeowners and students and workers?”

GOP backers have downplayed or outright ignored the bill’s gifts to big banks. Instead they claim it will revive community banks and credit unions, a sales pitch largely rejected by opponents.

Republicans are trying to conjure images of a small town Main Street bank with tellers who know customers by name and a bank president who sponsors the Little League team, a guest opinion writer argued in The Hill newspaper in March.

“Those are the banks that supporters of deregulation want you to think are helped by this bill, but it’s not really true,” wrote Nick Jacobs of Better Markets, a public-interest group focused on a financial system that is both safe and strong.“The biggest beneficiaries are 26 of the largest banks in the country. They are bailout recipients. They are recidivist lawbreakers. And they are foreign-owned banks. They are not community banks.”

Contrary to deregulation talking points, small lenders were shutting their doors long before Dodd-Frank was law. A study by the Center for American Progress (CAP) found that the decline began in the 1980s for reasons that include economies of scale and new technology.

“The data clearly show that charges that Dodd-Frank has dampened lending or crushed community banks are untruths used to peddle a deregulatory agenda that will benefit Wall Street megabanks,” CAP reported.

In remarks before the Senate vote, Brown recalled the audacious comment in March 2017 by James Ballentine, chief lobbyist for the American Bankers Association.

“I don’t want a seat at the table. I want the table,” James Ballentine told a conference of bankers.

“Piece by piece, Wall Street has gone to the agencies, gone to the courts, and gone to Congress to dismantle the protections we put in place,” Brown said. “The drumbeat is constant. They always want a new exemption, or a new, weaker standard, or a new tax break. And they are about to get it.”

International President Lonnie R. Stephenson urges IBEW members to call their senators and representatives at (202) 224-3121, the U.S. Capitol, or contact their home offices to demand they put working families ahead of big banks’ special interests.