January 2025 |

|

|

|

|

Print Print

Email EmailGo to www.ibew.org |

||||

|

||||

Since 2020, records have been set in segment after segment of the industry. First it was solar and grid storage. Then data centers, airports and semiconductor factories. Rural broadband rollouts, a U.S. manufacturing surge and unprecedented investments in infrastructure followed. As 2025 starts, everything is in overdrive. Over the next eight years, the Bureau of Labor Statistics projects there to be more than 80,000 new electrician jobs per year, double the rate of growth for any other skilled trade and nearly three times the rate of growth for all other jobs combined. "As big as we were always thinking, we were thinking too small," said International President Kenneth W. Cooper. "Record demand for our construction members is not in two, three or six industries — it's every industry. It's not most of North America — it's everywhere. A boom of booms." The size of the opportunity facing the IBEW is nearly impossible to overstate. Last year, the IBEW hit a construction membership all-time high with nearly 460,000 by adding more than 17,000 new members, a record gained. In the first three months of this fiscal year, the union is already more than halfway to last year's addition. "We've never had more construction members, and this is the fewest we may ever have," said Adrian Sauceda, director of inside construction organizing. "The best organizing tool there is is to be put immediately to work in a career with better pay and benefits, and we have that everywhere." |

|

|||

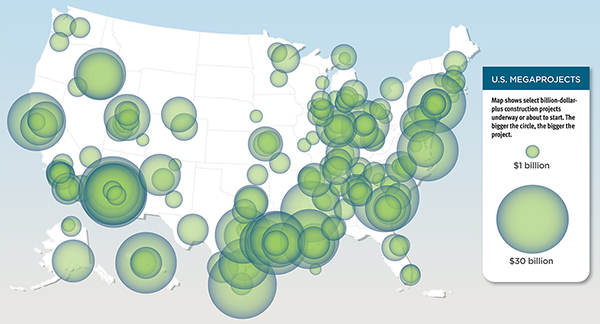

Booms have typically been regional and cyclical. For the next decade, demand for qualified electrical workers on just the $1 billion-plus megaprojects on this map will not only overlap, it will often exceed the supply of union and nonunion workers in their region. |

||||

Megaprojects Today, IBEW members are at work on more than 2,700 projects under construction with an estimated total value of over $650 billion. Construction and Maintenance Director Matt Paules gives another 6,400 projects a 70% or greater likelihood of moving forward within the next 12 months. These projects represent an estimated value of $805 billion. Almost 5,000 maintenance projects with a value of $13.5 billion round out the astonishing picture. And just 200 of these current or shovel-ready projects account for $500 billion of the total value. These megaprojects are so large and so numerous that they are distorting the national job market for construction electricians, said Aaron Jones, an international representative who leads marketing for the joint IBEW/NECA Workforce Recruitment Taskforce. "It is ridiculously easy to underestimate this. There are single jobs that require more electricians than there are in a state, next to another state with a project that needs more electricians than there are in that state. There isn't a shortage; there is a vacuum," Jones said. Fortune 500 companies are accustomed to competing for sales. They are not used to competing for construction workers, Jones said. But the transformation of the economy will reward developers that act fast, and the bottleneck for most construction projects isn't steel or concrete, Jones said. It's the construction electrician. "This is double the job growth we've ever seen in our history, and a big part of that — the biggest jobs — are in places that were ghost towns, rural areas and small towns like the one I grew up in, where opportunity was stripped away by bad trade deals and offshoring. The jobs are back, but the workforce isn't," Cooper said. And while this opportunity is unprecedented, there is still a way that the members of the IBEW go through the next decade and come out weaker than they are today. Given the choice, signatory contractors bid the work with the highest premiums. Companies facing extreme time pressure are only too happy to pay now to earn sooner. And a worker who can travel has any number of online tools to find out which jobs have the highest per diem and how much over scale they pay. But then the bread-and-butter work — maintenance contracts, tenant improvement, commercial, light industrial and residential construction — falls to nonunion contractors. While it doesn't have the premiums in pay and benefits that the megaprojects do, it dwarfs it in total size. Megaprojects are only one-seventh of the $3.5 trillion electrical construction industry over the next decade, Sauceda said. "During the last construction boom 20 years ago, our membership grew, our pension funds added billions of dollars, and we ended up with a smaller market share," Sauceda said. "The only way we hold onto the gains in wages, benefits and worker power is by growing our market share while we grow our membership and our hours." And this time, Sauceda said, the IBEW has the tools to do it.

"When a contractor or a customer comes to the IBEW now, the question they always ask is, 'Can you find the workers?'" Cooper said. "I can look anyone in the eye and say no one else is better at it than us." "We Power America is a joint venture with NECA focused on finding and organizing nonunion electrical workers at scale. Once they are identified, We Power America targets them individually, highlighting specific projects with open calls they can fill." "Since We Power America launched, we've had 250,000 applications for job opportunities where there are unfilled calls," Jones said. "Just in October, we sent out 290,000 postcards to nonunion electricians. The message was, 'We have opportunities nationwide.'" But there are two sides to the organizing equation. The first is organizing members and contractors. That is taken care of with We Power America, IBEWYes.org, Helmets to Hardhats, national ad campaigns, targeted ad campaigns, and direct outreach in person or by phone or email. The second challenge is putting people to work. And the IBEW has been making significant moves there as well. Since 2020, the IBEW inside apprenticeship program has grown from about 36,000 to more than 52,000 registered apprentices, a 44% increase in just four years. But it's not enough. In 2023, the Electrical Training Alliance introduced a federally approved plan for a four-year inside apprenticeship with the same number of on-the-job hours but leveraging more online and computer modeling classes to accelerate classwork and increase how many apprentices each local can indenture. "It's the same standards, same curriculum, but more apprentices becoming journeymen faster," Paules said. Then, just in the last few months, Cooper and NECA President David Long announced the most substantial change to organizing qualified electrical workers in decades. Now, highly experienced electrical workers can immediately sign Book 1 in the jurisdiction where they live and work, with the business manager's approval as long as they have at least 12,000 hours of experience. There is no justifiable reason to make a foreman, a superintendent or a wireman with years of experience wait if we have an open call now, Sauceda said. "We are giving business managers and signatory contractors the tools to move the best-qualified nonunion electrical workers into union jobs faster," he said. For anyone who has years of experience but hasn't mastered certain specific skills, the Electrical Training Alliance has hundreds of training modules, many of them available online. And no one can match the IBEW's experience in on-the-job training. "When we meet with contractors, it is very easy for the IBEW to say we are the best at organizing workers, we are the best at training them. What nonunion calls recruitment, we call organizing, and we''ve been doing it for 130 years," Jones said. |

|

|||

© Copyright 2025 International Brotherhood of Electrical Workers | User

Agreement and Privacy Policy |

Rights and Permissions |